Universal allowance/Basic income.

A universal allowance is a benefit that is paid to all New Zealander's - retirees, low income earners, high income earners, invalids, unemployed, students, solo parents, and replaces existing benefits (unemployment benefit, DPB*, pension, sickness benefit, working for families, student allowance).

There are no requirements, all New Zealand citizens (18 and up*) are entitled to receive it.

The rate would be about the same as the existing unemployment benefit (around $200-250/wk pp).

When people work, the money they earn, is earned on top of the universal allowance. The tax rate is hiked to cover the benefit paid to everyone.

Gareth Morgan advocates such a system, with a flat tax afterward.

http://www.bigkahuna.org.nz/universal-basic-income.aspx

Addressing the immediate objections:

- How do we afford this?

We increase income tax, which doesn't affect workers, because they're now getting an extra basic income. For example, if currently you are a worker earning $500/wk being taxed 20%, so your take home is $400.

In this system, a worker might earn $200 basic income, and $500 a week taxed at 60%, so their take home pay is the same.

Assuming that everybody who currently is working, still works, then theoretically it's possible to implement this system without any change to the basic tax burden/benefits of people. (That's a drastic simplification, but the idea is the same).

- People will just stop working and live on the benefit, if they're not subject to having to look for a job.

No they won't. People are still better off working. Some people might. For example, they might use it as an opportunity to try a business venture, or become an artist, knowing that they won't starve if it fails. Other people, are already gaming the benefit/sickness benefit system.

Advantages of such a system:

Reduce the cost of administering social welfare. Because beneficiaries are no longer subject to eligibility criteria, the bureaucracy associated with administering WINZ is drastically reduced. The payment becomes an automatic thing through IRD.

Reduce the hypocrisy of social welfare. Social welfare currently is riddled with incentivising dishonesty. For example people finding sympathetic doctors to sign sickness certificates, or lying about having a partner as to maximise their benefit.

Allow workers freedom of movement. Workers can take a chance moving someone where to look for work, knowing that they won't starve.

Allow economic innovation. Entrepreneurs can try their hand at business, knowing they won't starve if it fails.

Pensions:

This would reduce pensions to current unemployment benefit levels. I think this is reasonable.

*DPB: This is a bug bear of this system. Personally, I'm in favour of removing the DPB. I think the DPB allows people to have children in irresponsible circumstances, by making being a parent being a full time paying job, that one can't be fired from.

The (hard) system I propose, individual adults are still entitled to basic income. Children are not entitled to an income, until they are 18. Perhaps working for families can still exist, to help lower wage earners. To look after a child, parents need to either have a job, or pay for it out of their basic income. This shifts the responsibility for having a child on the parent, and hopefully disuades them from having children if they can't afford it. If people are struggling looking after children on basic income, they can get support from their family and community and charity.

Ofcourse, DPB shouldn't be cut off straight away, it should be phased out.

I'm aware that this is quite hard position, so if you think the idea otherwise have merits, then let me know what you think on this point.

Other issues to discuss:

The tax burden. Gareth Morgan advocates a flat tax on top of the basic income, but I think that's a bit unfair on lower wage earners. I still advocate a progressive tax system. Unless you had another scheme like a subsidised house buying scheme to help lower wage earners.

Colin Davies Thu 31 Jul 2014 7:58AM

@davidjohnston

I remember reading when Gareth Morgans first talked abt UBI, (unsure when). But had read up on it a lot earlier in respect to Brunei and somewhere else. So I'm not current with the modern thinking now.

You really need to look at the whole economy and have 1 big change to get things right.

For example kill all normal WINZ type weekly payouts.

As the UBI will cover this.

Restructure Income tax so it cuts in hard after a UBI figure.

eg UBI x 2

So people are not penalized for working up to that figure.

People earning 3 times the UBI the tax would cut out there UBI income. So only above that are taxpayers real income tax contributors.

Introduce other taxes, Capital Gains, Transaction, Estate, Speculation etc.

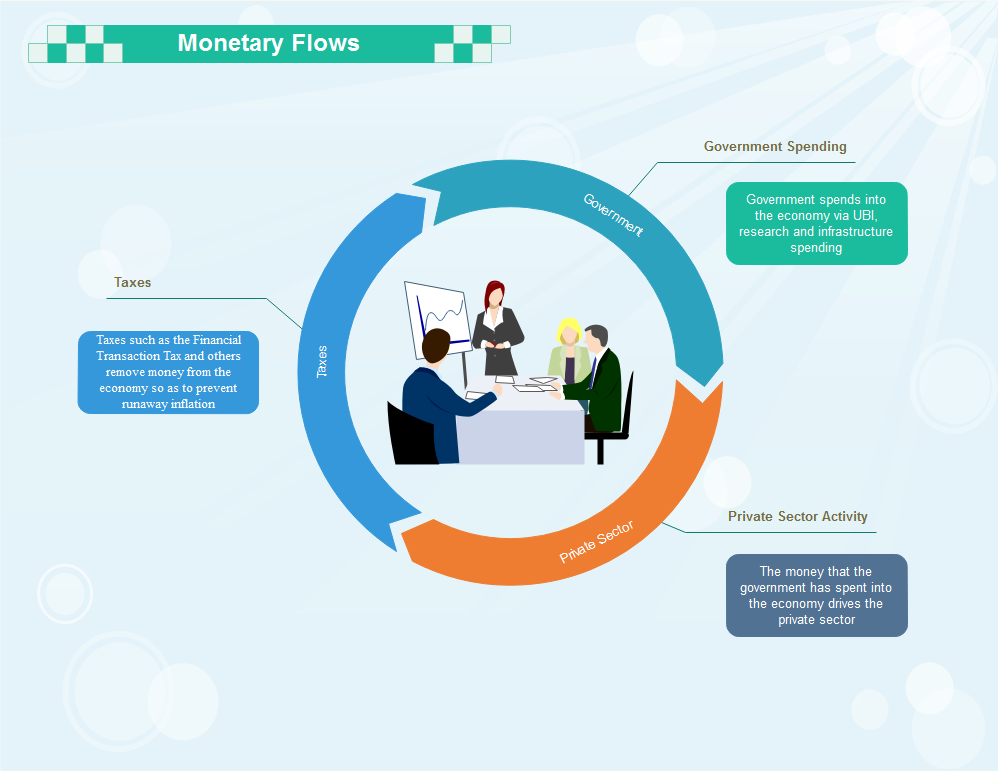

Now : note all the UBI better off people are your consumers. This should mean increased consumption, needing increased production, requiring a larger workforce. Meaning more people earning more.

However a danger exists if this is done wrong of a bubble bursting. So the expansion needs to be controlled to be just at a steady rate.

The best tool we would have in NZ for this is our GST.

In the normal UBI world the GST is just recirculating through the system.

example -> The govt collects the GST the Govt uses it to pay part of the UBI, The UBI users spend their UBI. The UBI goes into the GST component.

Now similar to how the Reserve Bank uses the OCR to control inflation, The Govt uses GST to control growth, Also the Govt uses talk to control the growth.

As the new economy matures the GST can be removed, possibly completely.

Under this system middleclass and above I believe will be in pretty much the same situation. However the beneficiaries and working poor will be much better off.

David Brown Tue 5 Aug 2014 5:20PM

Why give those who don't want to work more reasons not to? I don't want to pay for someone who thinks they are entitled to live a life without having to support themselves. Its just not right. Make them grow up

Colin England Wed 6 Aug 2014 1:59AM

I'm in favour of a UBI but it should be about $400 per week for adults. Less for children - which means that we should also have a universal child allowance. This higher amount ensures that no one is living in poverty as well as giving them enough money to be entrepreneurial.

The authors take on the DPB is, essentially, sociopathic and so I don't support that at all. That said, a higher UBI with a universal child allowance would replace the DPB anyway.

David Brown, Very few people refuse to work and most of those who do are in the upper echelons of society (they 'work' to get financial returns while doing very little of any real value). The only reason why we have unemployment is because, over the last thirty years, we've structured our society to have unemployment so as to force wages down. For many years NZ had 0% unemployment and we could do it again.

David Johnston Wed 6 Aug 2014 2:39AM

@colinengland That's an insane amount. $250 a week is perfectly survivable, for a single person, I don't know how think otherwise.

Re: DPB, this is a huge can of worms, so I'd rather take it into another thread.

Colin England Wed 6 Aug 2014 3:01AM

Not really. I'm not looking at enough to subsist upon after all but enough to go out and be entrepreneurial. Basically, enough to go out and do something rather than be forced to sit at home and have all your ideas come to nothing.

BTW, the ~$250 per week available through the UB + the housing allowance is 20% below subsistence level. Prior to Ruth Richardson's cutting benefits back in 1991 MOAB they had been calculated as being enough to live on and engage in the community. Now they're almost not enough to live on and participating in the community is pretty much non-existent.

Phil Caton Wed 13 Aug 2014 7:37AM

I support the concept of UBI and have compiled some of the online references to UBI on this blog -

Musings about Universal Basic Income

Gareth Morgan's book 'The Big Kahuna' is a good introduction to UBI, but I don't fully agree with his ideas about property / land tax to fund the initiative.

UBI should replace all current benefits - ie the MSD, WINZ and ACC functions are no longer required.

If additional income is required to meet the extra burden of physical and / or mental incapacity, then this is achieved through the health budget.

As all citizens are entitled to UBI, the income starts at birth with the early years' income being administered by the child's caregiver(s).

William Asiata Thu 14 Aug 2014 6:13AM

A societally inclusive UBI would play a part to facilitate the fulfilment of and bring security to all manner of basic human rights. E.g. The right to achieve individual and communal self-realisation. The right to live in a prosperous environment. The right to reproduce. The right to engage in trade, pursue entrepreneurial ventures, and establish businesses. Etc.

Devan Subramaniam Thu 14 Aug 2014 9:49AM

The concept has merit.

Phil Caton Sun 17 Aug 2014 8:21PM

I was pleased to hear Annette Sykes (Internet / Mana) make reference to UBI at the Wellington Internet Mana Party roadshow - as something that Mana would seriously look at;

also Laila Harre made passing reference to granting a 'living allowance' at the Naenae roadshow yesterday (Sunday).

I didn't ask what she meant by that.

John G Thu 21 Aug 2014 7:27AM

I'd prefer to see a government jobs guarantee. Full time work for anyone who wants it at a low but living wage.

The problem with a UBI is that you will at some point increase income faster than you increase productive capacity to absorb it.

That's how you get into inflationary hot water.

Phil Caton Fri 22 Aug 2014 1:14AM

@John G - I agree that those who want to work should be able to work - but what is the definition of work? Caring for an elderly relative or being a full-time parent does not equate to 'work' in the current government definition;

although that 'work' is probably more beneficial to society than the old solution of over-staffing state enterprises, like rail, post office and forestry, to provide the illusion of full employment.

With regards to the problem of UBI and inflation it may be better to stagger the introduction of UBI or, have a wage / price freeze during its first months / years of introduction to avoid the possibility of an inflationary effect which negates the whole concept of wealth re-distribution?

Colin Davies Fri 22 Aug 2014 1:30AM

@philcaton

Under most UBI ideas, the person you are caring for would also be receiving the UBI. Thus they could possibly supplement your income from theirs.

Also obviously in genuine cases of hardship extra assistance would be given.

The UBI won't solve all problems but I think we can assume it will change us from being a core welfare based nation. (unsure what to)

Phil Caton Fri 22 Aug 2014 6:18AM

UBI gets a mention by Laila Harre at about 9 minutes in on this TV3-hosted AMA

Laila Harre AMA

John G Fri 22 Aug 2014 6:44AM

Phil Caton

Certainly allowances should be made for those situations. I'd be paying higher sickness benefits, pensions etc as well.

The problem with inflation wouldn't be at inception, it would be constant and cumulative.

You'd run down your productive capacity.

John G Fri 22 Aug 2014 6:46AM

" the illusion of full employment."

Jobs are jobs. If everyone is employed it' s full employment. Not an illusion.

Colin England Fri 22 Aug 2014 10:26PM

although that ‘work’ is probably more beneficial to society than the old solution of over-staffing state enterprises, like rail, post office and forestry, to provide the illusion of full employment.

Were they, as a matter of fact, over staffed? Considering the very manual labour involved in many government operations (MoW, Telecom, Power, etc) they actually needed a lot of people. IMO, We don't have fibre to the home today despite starting the roll out of it in the mid to late 1980s because Telecom no longer has the manpower to do it (Nor the will - why spend money on something when you can milk the copper that was rolled decades ago?).

Marcus Davis Sat 23 Aug 2014 4:12AM

invaild welfarepayment (supportive living payment) is hard to live on as i live with a disability that make employer turn me down with work

Marc Whinery Sun 24 Aug 2014 11:59AM

The bank profits are about $20,000 per household. If we just found some way to get the bank profits to stay in the country, it would fund the UBI. Bank gross revenues are enough to give every household $80,000 back per year.

Even if we didn't collect that $80k directly and redistribute it, just having that go to productive uses would boost the economy greatly and end up paying $20,000,000,000 a year in taxes on its use. That'd fund the UBI.

The secret to paying for everything is to abolish traditional banking.

Colin England Sun 24 Aug 2014 7:06PM

The secret to paying for everything is to abolish traditional banking.

That's part of it. Another part is to get rid of foreign ownership (That's how you get profits to stay in the country).

Fred Look Mon 25 Aug 2014 10:11PM

how do we define work? is it producing something to service the interest payments on "investment" or is it doing things that benefit society? a UBI would recognise and enable the people that do good essential stuff for free. Remember that before the labour government of 84 New Zealand had a thriving voluntary sector. We were much better for it

John G Fri 29 Aug 2014 7:01AM

There are plenty of things need doing that capital can't or won't do. Or would not without a government subsidy to rent seeking.

Nor is it in capital's interest to provide full employment.

The government needs to be the employer of last resort and provide full time jobs to surplus (to capital) labour.

Maelwryth Fri 10 Oct 2014 9:42AM

A couple of days ago I was trying to come up with a scheme to handle the effects of increased computerization and mechanisation. Possibly it could be a feed in to the UBI but I am unsure of the effects.

Basically, we take stock of where we are today with tech and say one person can do (this amount) / (work day).

Having established that, when a disruptive event happens such as faster computing, or more efficient grape picking machinery, etc... then you have to buy that amount of person hours at 20% of the actual cost.

Eg; Farmer used to spend 100 days digging his field to earn $100. Farmer buys tractor, which means he only has to spend 1 day digging his field, but he will also have to buy 20 days worth of labor.

The numbers are mutable. Play with them as you wish. The standard unit of labor would be the hardest thing to come up with. The money spent buying units of labour would go to the general population (UBI).

Deleted User Fri 10 Oct 2014 10:10PM

@tane one problem with this idea is that new businesses will pop up starting out with tractors and not pay as much. Legislating a UBI is much more efficient and fair.

Maelwryth Sat 11 Oct 2014 10:22AM

@mattkraemer I was thinking more of marking a line in the sand, say the millennium, and starting from there....or today if you wanted, or one years hence on the same day to give people time to figure out the labor costs. It's the line that is important.

So, using the tractor analogy again. If the mark is made as 1st January 2000, then any tractor manufactured after that date that was more efficient would have an added cost to pay the population for that loss because that efficiency came by excluding a human from the job market.

Legislating a UBI may be more efficient and fair, but it also looks like it would bankrupt the country fairly easily if pressure was applied to it.

Deleted User Sat 11 Oct 2014 3:50PM

Hi @tane , what pressure do you see that could bankrupt the country in Gareth Morgan's plan?

As for your idea, it would instantly take every exporting company back 14 years of international competitiveness. They will all shut their doors or go bankrupt. This why simplicity it's so important. I'm a serial entrepreneur, but most people haven't a clue about business. Complex rules get made by people who haven't run their own businesses (like Russell Norman) and these rules all have collateral damage in the market making some people lose everything and making others into kings.

Maelwryth Sat 11 Oct 2014 7:53PM

At current levels and using last years expenditure for Social security and welfare (http://www.treasury.govt.nz/government/expenditure) and dividing by the population (roughly 4.5 million) gives you $6067/year to live on. To even get close to a livable wage you would need roughly 3 times that which would mean your expenditure of $27.3 billion for Social security and welfare would jump to $81.9 billion. Current total crown expenses for 2015 are expected to be roughly $95 billion, and paying everybody $18000 a year to live on would make that $136.5 billion a year plunging us into debt by $54.6 billion every year.

I am not an economist. Please check my figures, but this would appear to be bankrupting the country unless there is an increase of at least $54.6 billion in tax intake.

Colin England Sat 11 Oct 2014 7:57PM

Consider a point I made a couple of days ago:

The purpose of the economy is to eliminate poverty. If we have poverty then the economy is failing.

A UBI would help to achieve the elimination of poverty and thus help the economy achieve its purpose.

Colin England Sat 11 Oct 2014 8:02PM

@tane

As long as we have the resources to provide what our people need while not over drawing those resources then our country cannot go bankrupt. Money is a tool to utilise those resources and nothing more. It most definitely is not a resource itself.

BAU is, of course, pushing us towards over drawing those resources all so that a few people can have more money.

Deleted User Sat 11 Oct 2014 8:20PM

That is why Gareth Morgan's plan of capital based taxing is so important and needs to be included in the conversation. @tane, your math seems good enough to me.

John G Sat 11 Oct 2014 8:27PM

Tane Harre

At current levels and using last years expenditure for Social security and welfare etc.

You can't extrapolate macro like a household budget.

Sovereign 'debt' is not like a loan and the NZ government can never be bankrupted in the currency that it issues at no cost.

The problems with UBI are not cost per se. Much better to have a full employment programme where you increase production in line with the additional spending.

Colin England Sat 11 Oct 2014 9:50PM

Sovereign ‘debt’ is not like a loan

It's exactly like a loan as it happens to be loan as I showed you. The only real difference is that a nation almost isn't allowed to default. The rest of that sentence I agree with - the problem is that our government issues very little money and actually does take out loans to cover its spending.

Much better to have a full employment programme where you increase production in line with the additional spending.

Productivity is already so high that we can't maintain full employment under BAU.

BTW, the darkened A under the comment edit window has information about how to format your comments.

John G Sat 11 Oct 2014 10:14PM

Draco T Bastard

Sovereign ‘debt’ is not like a loan

It’s exactly like a loan as it happens to be loan as I showed you.

You didn't show me anything of the sort. You've merely misinterpreted the system. Government bonds are asset swaps, not loans.

So called government debt is non-government financial assets.

The government can employ all (surplus to capital) labour.

Colin England Sun 12 Oct 2014 1:29AM

Government bonds are asset swaps, not loans.

No, they're a loan of money with interest recorded through the bond. The government uses more than just bonds as well - derivatives and other debt vehicles are also used.

The main point though is that none of these are needed.

John G Sun 12 Oct 2014 2:30AM

No they're not. If they were loans there would be a balance sheet expansion.

The opposite is the case with government 'debt'. It is a direct swap of reserves for bonds.

And on maturity, vice versa. Otherwise the maturing bonds would have to be a line item in the government's fiscal statements. Which they clearly are not.

You haven't come to terms with the difference between horizontal (bank credit) and vertical (government) money.

http://heteconomist.com/verticalhorizontal-vs-exogenousendogenous/

While the bonds are not needed as you say, the distinction is important in understanding how the system works in practise.

Colin England Sun 12 Oct 2014 6:47AM

If they were loans there would be a balance sheet expansion.

noun

1. the act of lending; a grant of the temporary use of something: the loan of a book.

2. something lent or furnished on condition of being returned, especially a sum of money lent at interest: a $1000 loan at 10 percent interest.

3. loanword. verb (used with object)

4. to make a loan of; lend: Will you loan me your umbrella?

5. to lend (money) at interest. verb (used without object)

6. to make a loan or loans; lend.

You seem to have ascribed a meaning to the word loan which is completely wrong. When talking about bonds we're talking about meaning #2 and #5. There's nothing there that says that a loan must create more money in the system.

pilotfever Sun 12 Oct 2014 7:22AM

@tane Don't pay them in BAD pay them in a renewable New Zealand energy credit instead. You may find $NZD6k in energy at $NZD0.50 / kWh enough in a energy accounting economy, it's an improvement to H.a.n.d.s and other schemes which works over larger distances and for larger and smaller purposes (including cooperatives). Usury free, non-tradeable (except for domestic use) against $NZD

pilotfever Sun 12 Oct 2014 7:24AM

This parallel domestic currency I call the Universal Bonus Income because everyone deserves a bonus.

Maelwryth Sun 12 Oct 2014 9:12AM

@jamesabbott The total revenue of the NZ electricity market is only $10 billion or so per year. I don't think there is going to be enough money there.

Also, I have looked at the Big Kahuna website and found that it doesn't handle negative EBIT numbers. Is this a programming fault, or does EBIT always have to be an absolute number.

John G Sun 12 Oct 2014 5:00PM

Draco T Bastard

If you accept that your bank account is a loan to your bank, then yes.

It isn't helpful to understanding the system though.

Marc Whinery Mon 13 Oct 2014 9:49PM

@johng1 " Government bonds are asset swaps, not loans."

If I swap assets with someone, and they repay the asset with interest, that's called a "loan", whether it's done at a pawn shop, or a bank or a government.

Colin England Mon 13 Oct 2014 11:23PM

The money in your back account is a loan to the bank. A major problem is that a lot of people don't realise that and think of it as being safe when it's actually at risk. This seems to have been a conscious misrepresentation by government and the banks since the Great Depression.

John G Tue 14 Oct 2014 4:57PM

Marc Whinery

A bank loan is different.

John G Tue 14 Oct 2014 5:49PM

Draco T Bastard

Government bonds are like moving money from your cheque account to a term savings account.

The bank's reserve balance is debited in return for a treasury certificate.

Colin England Tue 14 Oct 2014 8:07PM

@johng1

A bank loan is different.

- Not really and

- That doesn't change the fact that bonds are a loan.

The bank’s reserve balance is debited in return for a treasury certificate.

So why do they need a triple A credit rating to do that? I figure it's either because bonds are a bank loan and/or because there's no way to tell the difference between whether an electronic dollar is a reserve dollar or not. Basically, I figure that a bond is bought with a similar ratio of bank money to reserve money as what's in circulation - about 98% bank money.

Fred Look Wed 15 Oct 2014 5:54AM

two big gains from a Universal Allowence

1 productivity.... people can be much more mobile and find a job that suits their situation and interest.

2 health...... people are not stuck in a job that is killing them

John G Wed 15 Oct 2014 4:57PM

Draco T Bastard

So why do they need a triple A credit rating to do that?

They don't. Sovereign credit ratings are nonsense. Political nonsense.

Colin England Wed 15 Oct 2014 6:03PM

@johng1

The Registered Tender Parties (The institutions buying the bonds off the government) are required to have AAA- credit rating to purchase the bonds. Surely, if they were just swapping reserve currency for bonds, that wouldn't be needed because there would be no credit involved.

Freida Maverick Wed 15 Oct 2014 8:28PM

The point of a Universal (Unconditional) Basic Income is that it is enough to provide for basic physiological needs - shelter (housing), food, energy (power). If it doesn't do this then we would still need WINZ for people who can't find jobs. I strongly advocate for an Unconditional Basic Income, but if it is not properly funded it will fail. I suggest that it should be something in the region of $350 per week, per adult aged 18 years and over. The tax rate must be progressive to a top rate of 90% for income and profit over $500k p/a. A UBI will do away with the need for 'benefits' (dole, DPB, etc), pension, and student allowance. The argument over 'retirement age' will no longer be relevant. Survival security frees people to be more innovative, more self-sufficient, to be happy with part-time jobs, and to settle in one place and create communities. When the IMF calls for increased growth and mobility of labour (as it did last week), we can be sure that that is exactly what we don't need.

Fred Look Wed 15 Oct 2014 10:59PM

Stongly support UBI. Our society has reached the point where so much effort goes to "work" that the basic civic effort cannot be maintained. We need urgent rebalancing this UBI would acheive.

John G Thu 16 Oct 2014 7:36AM

Draco T Bastard

The Registered Tender Parties (The institutions buying the bonds off the government) are required to have AAA- credit rating

I guess they want to maintain an exclusive club of primary dealers. There's big commissions to be had after all.

Surely, if they were just swapping reserve currency for bonds, that wouldn’t be needed because there would be no credit involved.

The accounting says otherwise. You need to learn it.

Jo Booth Sun 9 Apr 2017 4:01AM

Was just listening to this one - http://www.huffingtonpost.com/entry/universal-basic-income-could-actually-work-heres_us_58d3cadde4b062043ad4b047 article by an IP member. :sound:

Daymond Goulder-Horobin Mon 1 May 2017 2:04AM

We can increase Taxes, in particular for the rich, (targeting those who earn more than $200,000 a year for instance). Its fairly obvious that the rich who are not interested in Charity will argue some rhetoric about people getting money for nothing or the fact that people who earned over a million dollars a year "earned it" but really it is about whether you actually have a right as a person to basic necessities in life. Ill admit that at first when I looked at the UBI I thought It would create problems with price levels in the economy or something like that but it actually equalizes everything nicely.

The only negative is that the rich will have to wait a bit longer for there Luxuries, Which is something I think they can live with.

Colin England Mon 1 May 2017 4:30AM

We cannot afford the rich. They're the ones who, through their greed and hubris, destroy societies.

https://www.theguardian.com/environment/earth-insight/2014/mar/14/nasa-civilisation-irreversible-collapse-study-scientists

http://inhabitat.com/nasa-funded-study-predicts-impending-collapse-of-industrial-civilization/

In other words, we need to legislate the rich out of existence.

Daymond Goulder-Horobin Mon 1 May 2017 6:42AM

Perhaps by Taxing the rich and pushing this policy through parliament we can at least balance it out and make the less fortunate better off. The greedy will of course attempt to use their connections to block any sort of income redistribution policy but at least we can improve things. One step at a time.

Josh Rich Tue 2 May 2017 6:54AM

"Taxing the rich" May be a good thing to say n all but its not very productive for a party thats also for growing industries :P

If UBI was to be Implemented the budget we have currently for welfare should be enough for $110 for every NZer a week.

Starting off from the getgo from 200 or higher might have unintended effects that might be hard to predict/control and IMO better off to start off small.

$100 a week is a lot for those on the lower end and still enough to make a difference for the lower middle class.

I pulled the numbers in the picture from a quick google :)

Daymond Goulder-Horobin Tue 2 May 2017 9:01AM

Taxing the Rich means taxing there profits, I guess to evade tax they could simply focus on growing their industry to increase their stock value and reinvesting Dividends from the Rich that make there money from Dividends. But your right in that we don't need to rush to $200 each and can start from ensuring that people have the right to eat which $100 would provide (as in 2 minute noodles and Luncheon :sweat_smile: )

Colin England Tue 2 May 2017 10:40AM

"Taxing the rich" May be a good thing to say n all but its not very productive for a party thats also for growing industries

Don't need rich people to grow industries. In fact, throughout history, it's been governments that have grown industries. It's just that a few psychopaths them made out like the bandits they are and stole all the benefits.

If UBI was to be Implemented the budget we have currently for welfare should be enough for $110 for every NZer a week.

Change the money-go-round from the delusional one we have to one that actually works:

The UBI becomes the monetary base for the entire economy. It won't be taxes that pay for the government but the government spending that pays for the economy to work.

The rich aren't inherently evil!

Considering the destruction that they cause - yes they are.

Josh Rich Wed 3 May 2017 2:00AM

Don't need rich people to grow industries. In fact, throughout history, it's been governments that have grown industries. It's just that a few psychopaths them made out like the bandits they are and stole all the benefits.

Citation, please?

Considering the destruction that they cause - yes they are.

Destruction from an uncompassionate gov or some guy sitting in a penthouse laughing?

I find this to be a rather dividing stance to take.

Colin England Thu 4 May 2017 2:50AM

Citation, please?

http://marianamazzucato.com/entrepreneurial-state/

Destruction from an uncompassionate gov or some guy sitting in a penthouse laughing?

Just their actions. It is the act of becoming rich that pushes a society into unsustainable use of resources, that push the majority of people into poverty and eventually destroy the society.

Nasa-funded study: industrial civilisation headed for 'irreversible collapse'?

It finds that according to the historical record even advanced, complex civilisations are susceptible to collapse, raising questions about the sustainability of modern civilisation:

"The fall of the Roman Empire, and the equally (if not more) advanced Han, Mauryan, and Gupta Empires, as well as so many advanced Mesopotamian Empires, are all testimony to the fact that advanced, sophisticated, complex, and creative civilizations can be both fragile and impermanent."

By investigating the human-nature dynamics of these past cases of collapse, the project identifies the most salient interrelated factors which explain civilisational decline, and which may help determine the risk of collapse today: namely, Population, Climate, Water, Agriculture, and Energy.

These factors can lead to collapse when they converge to generate two crucial social features: "the stretching of resources due to the strain placed on the ecological carrying capacity"; and "the economic stratification of society into Elites [rich] and Masses (or "Commoners") [poor]" These social phenomena have played "a central role in the character or in the process of the collapse," in all such cases over "the last five thousand years."

5000 years of history tells us that we cannot afford the rich.

Josh Rich Tue 2 May 2017 9:31AM

The rich aren't inherently evil! :P

To me UBI should cover the very basics, if you want more with luxuries you gotta work for it.

One of my concerns is it would make rent sky rocket.

Daymond Goulder-Horobin Thu 4 May 2017 5:01AM

Prices would increase, but not as much as the UBI, so one of $100 might raise rents by $40 or something, ($40 more than it would normally). Its just a guess though, really the UBI puts buying power back into everyone else's hands and of course that is dependent on the marginal effects a firm faces (whether its more profitable to make more units or increase the price level).

Ultimately by how much it increases will reflect how capable New Zealand is at feeding its people. if it does not increase much then it means that we can sufficiently provide basic needs to everyone, if it skyrockets then it shows that we need to invest into growing our industries further to make more units and increase and manage our resources (sort of what the Venus Project wants to accomplish) or reduce the costs of production through improving technology which the internet party should be best at analyzing. Or maybe Export less to China .

Josh Rich Fri 5 May 2017 9:03AM

We got a bit off topic ;)

Or maybe Export less to China .

What makes you say that?

Daymond Goulder-Horobin Fri 5 May 2017 9:19AM

The part about exporting less to China was mostly a joke :sweat_smile:

... Then again if prices go up in New Zealand firms would have more incentive to sell locally so it might just happen anyway.

Daymond Goulder-Horobin Wed 3 May 2017 3:27AM

Usually when we talk about the rich people being evil we firstly mean the ones that are bank rolled by corporate interests. For instance a significant number of U.S politicians being lobbied by the cigarette industry to say "Its there choice" or even H.R Clinton being paid by Wall Street to pretty much do there bidding (Who can be considered evil in themselves). Not so much from an "uncompassionate" govt but simply one that has been bought out by the rich and powerful (and Evil).

Money gives you capabilities to grow through funding but Ideas can come from everyday workers to stimulate growth, and this can come from Government Initiatives so individuals with a lot of capital are not "critical" to industry growth although it helps.

In saying that I would argue that around roughly 80% of the rich are dodgy and evil as England states. But sometimes someone just comes up with a good idea (That helps society not hinders it) and it solves a problem, becomes successful and gets rich. You will find that most of the rich that are idiots are ones that got lucky on the stock market, Sold out or made a terrible product that happens to sell, Such as Cigarettes.

Any rich person who tries to argue against any sort of UBI is probably evil too.

Colin England Thu 4 May 2017 3:04AM

Usually when we talk about the rich people being evil we firstly mean the ones that are bank rolled by corporate interests.

No, just being rich is the problem.

In saying that I would argue that around roughly 80% of the rich are dodgy and evil as England states.

No, more likely 95%+

Social mobility is now almost extinct.

But sometimes someone just comes up with a good idea (That helps society not hinders it) and it solves a problem, becomes successful and gets rich.

That does happen but not as often as you like to think. Most of the good ideas actually come from the workers which means that the owner(s) claim ownership of it and grab the rewards. The worker usually doesn't even get a bonus.

You will find that most of the rich that are idiots are ones that got lucky on the stock market, Sold out or made a terrible product that happens to sell, Such as Cigarettes.

Most of those types are simply born into the wealth.

The ‘Self-Made’ Myth: Our Hallucinating Rich

The basic conclusion from these findings: Forbes is spinning “a misleading tale of what it takes to become wealthy in America.” Most of the Forbes 400 have benefited from a level of privilege unknown to the vast majority of Americans.

In effect, as commentator Jim Hightower has aptly been noting for years, most of our super rich were born on third base and think they hit a triple.

Daymond Goulder-Horobin Thu 4 May 2017 4:48AM

Lets just agree that increasing taxes on the rich and implementing the UBI is a start to balancing out the economy and ensuring that a persons right to live is respected. At first we would need use the taxes to pay for the policy implementation.

We can safely assume that any rich person who makes over $500,000 per year and argues against any sort of UBI is evil. The ones that fight us on any income redistribution are the ones that don't care about the people and will likely make up stories about how they earned their money and that everyone else simply isn't trying enough or some garbage.

Through proposing the UBI we can draw the corporate elite out into the open and then proceed to humiliate them. The argument for it I believe is solid so at debates just laugh them off.

NB: Expect a lot of resistance from the Elite if we fully implement this into our policy or more specifically any sort of tax increase on the rich.

Colin England Fri 5 May 2017 2:29AM

I think a UBI needs to be implemented with a change in the banking system.

how the banking system works has come out in recent times. And from that it's clear that the banking system actually doesn't work - that it is either a Ponzi Scheme or Pyramid Scam.

Now, the banking system is used to fund our society but it's done in a way that ensures ever increasing debt with the inevitable result of collapse. The Great depression and the great Recession are both great examples of the collapse that banking system brings about.

So we change the banking system so that private banks can no longer create money. The only way that they can make loans is if they got reserve currency deposited for that purpose.

The obverse of that is that there will be a huge decrease of new money in the system. To replace that decrease the government would spend money into the economy. Even if the government spent all it needed to on infrastructure, education and R&D there still wouldn't be enough and that's where the UBI comes in.

Basically, the UBI becomes the funding for society.

Taxes wouldn't be there to fund government but as a monetary control system.

Josh Rich Fri 5 May 2017 10:33AM

Well I can say in fruits, its just cause they value good fruits overseas more than we do and pay stupid amounts for them :)

Stephen Dickson Sun 11 Jun 2017 9:22PM

The funding is simple. Actually tax the corporations that take their profits offshore. And tax them HARD. A UBI at 100 or even 200 isn't much use. Basic income needs to cover the basics. 100 doesnt even buy food for a week, not proper food.

Ryan Mon 3 Jul 2017 3:47AM

UBI is definitely a really good idea, it has so many applications to improve the country, especially poverty and the economy. Not only is it already rolled out elsewhere in the world, but some of these places have had the equivalent of UBI since the 70's...that's ages ago!!

I agree that basic income needs to be a bit more than $200, something like $260 would make more sense...and perhaps leave the $100 or $200 amounts to a later time when the economy is far better off and requests for it are more rare.

That being said, with some of the Internet party policies about solving hunger, people may not have to worry so much about spending big on food...or at least some food centers could explore ideas like hosting communal meal events every now and then (chuck a movie on, bring people together!).

Here's an overview of the globes UBI-esq services in place:

http://ubi.earth/

Alaska in particular is the one that comes to mind first, they established a permanent fund back in the 70s and based it on the market of oil and mineral resources:

https://en.wikipedia.org/wiki/Alaska_Permanent_Fund

Just the length of time that's been around is already a good sample of data, to see what people would use it for. For those who don't use it to try and start ventures/small businesses/become an artist, or to simply improve their education or well-being, they mostly put it towards other rational stuff like vehicle repairs, buying basic necessities to live, or even just saving it to go towards a home, etc:

https://qz.com/1018413/new-survey-by-the-economic-security-project-finds-alaska-residents-strongly-support-preserving-a-universal-basic-income-ubi-from-the-alaska-permanent-fund-dividend-rather-than-cut-taxes/

All of these uses are the complete opposite of the arguments against UBI...claims that a majority of people would just sit around and do nothing. While I'm sure a small few would choose to do this, I'd rather that be the worst outcome of taking a risk....than far worse things such as mass famine and poverty, or people becoming so burnt out / over-worked from week to week living that they can't even consider things like starting a family, or a business. That is when your society no longer moves forward, and that's very dangerous.

This will also help out those who may be over-skilled and unable to compete for positions in lower wage jobs (eg. being stuck on short-lists), and want to consider starting their own business instead or even just volunteering in the community. A lot of people are leaving highschool now with skills that were originally only taught in college no less than 6 or so years ago, so to try and compete with those newly entering the workforce...it's a tough one for sure.

UBI would also mean that those interested in volunteer work could now afford to live, and may choose to leave regular jobs (or to cut down their shifts) in order to help non-profits in the community...so now we have a lot more jobs being freed up for existing Kiwis (and also those immigrating to New Zealand) to apply for.

Now, there is certainly an upcoming market that New Zealand could base the UBI off of in terms of taxes or profits; the drug reform around cannabis.

If we decriminalize it and legalize it in a rational and controlled manner for consumption (eg weed vapes and oils in cafe food, not smoking), growth, sales and import/export, the Government can use sales taxes and export profits to fuel UBI for more than one year.

That gives us another additional source of funding UBI, alongside existing ones such as kick-starting it via forgotten, unclaimed tax returns. One of our primary permanent fund resources would essentially be weed (as well as the results of other changes like a flat tax rate), which as a country of agriculture would be a pretty awesome path for New Zealand to take. I'm sure countries such as the US would gladly import from us.

The other positive outcome that could come from UBI is, people renting or flatting together who are splitting costs between each other may end up having excess money left over after rent/living costs, so they can now pump some money back into the economy and buy more things. So the economy now sees a huge spike of profits come in, which could go into schemes like profit sharing back to employees or the community...to ensure they are paid better wages and to fund community projects or events (aka get reeeaallly good PR).

This is huge in terms of shifting the economy, as it would essentially mean that many can now afford to seek out more items of luxury in their life, to improve their well-being/happiness...perhaps something as simple as owning a blender, learning an instrument or having a gym membership is a concept they've had interest in but never been able to afford after their weekly bills are paid.

The final big one is obviously how much this would solve poverty. Not just for families either, across all groups. Our country is seeing increasing levels of poverty even for adults who aren't raising families, and also among youth in general...so UBI would certainly be something to strive for if we want to change this sooner, rather than later.

Combine that with the housing solution proposed by the Internet party, as well as the other policies in discussion, and you are pretty much set for permanently changing New Zealand for good.

Colin England Mon 3 Jul 2017 9:35PM

Not only is it already rolled out elsewhere in the world, but some of these places have had the equivalent of UBI since the 70's...that's ages ago!!

We've had a limited UBI ever since we put in place our pension scheme.

All of these uses are the complete opposite of the arguments against UBI...claims that a majority of people would just sit around and do nothing. While I'm sure a small few would choose to do this

The majority of people would keep working because being unemployed is really quite boring.

That gives us another additional source of funding UBI,

Funding a UBI isn't a problem - once we look at how money should flow in the economy. The money should flow from the government into government services, from there to the private sector and then back to the government.

When we do that then the UBI becomes a major fund for the the economy and we no longer have any issues with being able to afford anything. If we have the resources available then we can do it. And we do have the resources which means we can freely develop our economy.

Ryan Mon 3 Jul 2017 10:15PM

Good points Colin. You're correct about our limited version in the pension scheme, hopefully UBI will be something to strive towards that, like the one mentioned from Alaska, is able to exist without such limits in place.

Being unemployed is certainly very boring, especially without a guarantee that your basic living costs are covered. It knocks out a lot of options....essentially making risk-taking far less appealing, and minimizing the motivation to learn or try new things (improving education, or trying to start a business) ...and not only that but you're left with only seeking out the more extremes of full-time employment, rather than being able to take on things like casual jobs.

Casual jobs are the kind of roles that I feel would become far more appealing in a society where UBI is provided.

I agree about already having the resources to fund UBI, so I guess knowing that there's additional extra sources to look towards would just be a bonus for those who might be skeptical at first about the stability of it. If anything it just shows that we are more than ready to freely develop our economy.

Edit: I forgot to mention that UBI itself is not a solution to poverty, but combining it with other policies as well. Flat tax + UBI would be one ideal way to bring it about...as well as the reform laws too (a lot more jobs after drug reform, so a big area for flat tax to apply to).

Bruce King Mon 28 Aug 2017 11:16AM

Scenario for a reasonable UBI in NZ and how to pay for it...

Bruce King Fri 1 Sep 2017 4:48AM

That UBI scenario pays for itself. This was checked on the figures from the 2016 NZ economy:

Bruce King Fri 1 Sep 2017 4:49AM

Bruce King Fri 1 Sep 2017 4:51AM

The calculations for that check are explicit & simple. Here is the one for A) Individuals tax:

Bruce King Fri 1 Sep 2017 5:38AM

And here is the simple calculation for B ) Corporate tax:

pilotfever Fri 1 Sep 2017 6:13AM

Human beings are inefficient in many respects. if you consider denominating the new economy in KWH because a tractor has limited maintainance costs when not in use. Arguably we don't turn humans off. If you consider the energy in and energy out of a process as well as its productivity you can calculate hourly rates in KWH.

Infact, I have argued for years taking this one step further and paying the UBI as a parallel domestic currency energy credit not unlike they do with kilowattcards.com ( http://kilowattcards.com ).

Then, we take the renewable energy God gives us captured by our people owned energy infrastructure such as wind, solar and hydro and divide it up into the proportions discussed to settle in energy surplus.

The awareness of power consumption and reward for using more efficient processes and machines in this scheme will not make human labour cheaper but protect jobs and incomes by replacing them gradually with increases in UBI.

Bruce King Fri 1 Sep 2017 12:06PM

Interesting, Pilotfever, and there are many options for paying for the UBI. Could even use cryptocurrencies, Government-issued money etc., or some combination. The scenario I did takes the plain vanilla option where the UBI is paid for by income taxes - specifically, a flat tax at 49%.

Bruce King Fri 1 Sep 2017 12:09PM

Here's the rest of the calculation. Takes 2-3 more slides but is explicit and the complete calculation showing the UBI scenario pays for itself in the modern NZ economy:

Bruce King Mon 4 Sep 2017 7:22PM

And here's how the taxation changes look in practice. The higher flat tax rate of 49% - which is identical to Australia's highest income tax rate - is at least partially offset for everyone by the basic income payments. The net effect is that 73% of New Zealanders do better and only NZers with incomes well over $100,000 will do notably worse - tax on high income earners is now much like in Australia and other comparable OECD countries rather than like Colombia and Swaziland, which share NZ's current highest income rate of 33%.

pilotfever Wed 6 Sep 2017 5:23AM

Excellent work Bruce. I trust it all works out!

Todays inspiration came in the form of this leger to parliament

"Dear members of parliament,

Nearly 20 years of entrepreneurship has taught me this: the system benefits the few at the expense of the many.

Most, if not all of you have dropped the ball on UBI and its mechanism for growing our economy, and yet I wish to propose something simpler and to UBI opponents something quite distinct.

Give $10000 NZD a year to recipients of the A Bursary (I obtained mine in 1997) each year they earn less than $45000 NZD in taxable income until they turn 65.

You can call these top scholars UB[i] champions or UBers or just $9800 NZD a year richer for at least 5 years because $200 NZD a year was ridiculous.

All that such a small sum did was flag sheep for the slaughter when we ventured to the patent office at the mercy of banks and the transnationals.

My reasoning is simple. If you are smart enough to get an A Bursary in 1997 and yet earn less than $45000 NZD a year you are capable of stimulating the economy and doing something great for the country if you arn't already.

We need to champion and protect innovation and technology in our country and provide a stepwise process for this to occur.

Our government services must protect young entrepreneurs from corporate espionage.

Attached a link to some slides demonstrating how a flat tax might work.

https://www.loomio.org/d/xAB9ThWv/comment/1453443

My preference remains pay for a UBI with a government issued universal energy credit as a parallel domestic currency. Literally there are many ways to pay for UBI and yet what I am suggesting is rewarding top scholars as UBI champions to stimulate the economy.

Best regards,"

James Abbott

@AbbottMaverick

Colin Smith Thu 7 Sep 2017 11:04AM

UBI = Money from the government = raised by taxes

Gov Benefit = Money from the government = raised by taxes

Tax Cut = Money from the government = by not taxing us in the first place.

“ALL” of the above have exactly the same effect because they are ALL exactly the same. The only thing that has changed is the name of the package. They all come from the same source and have the same effect on the system.

Funding the UBI: They have been trying to tax the rich not just for our life time but from the time currency was invented. How are our tax policies different from anything that has been presented before? We are dreaming if we think we have the answer to be able to tax the rich!

The biggest profits that arise from New Zealand are made AFTER the products / services have left our shores. These profits made - do not flow back to New Zealand and they stay offshore. These do not fall into our taxable arena for us to charge tax. If there was a way then the larger parties would have found a way to achieve this already.

When our lands are stripped of all resources (Gold, Metal Ore, Water) and milk, meat and veg are cheaper to grow in a factory scale laboratory overseas. (Which it is already – it is currently being scaled up) What are we going to sell to purchase the necessities of life for all kiwis. Just who are you planning on taxing to fund this when this occurs.

Puerto Rico is already at this stage. They have nothing of value to sell - they have been stripped of all assets. The government is attempting to declare the country bankrupt. But the BANKS will not let them. According to the banks they must keep borrowing to pay back the loans they already cannot afford to service.

These are called "aid packages", but still need to be paid back. BUT WITH WHAT?

Puerto Rico bankruptcy court

(It is worth investigating who is actually running the country and who is backing those who are in power. The Federal Bank seems to keep showing up in the most unlikely of places)

The global homelessness, joblessness are all symptoms of a failing economies and everyone is starting to notice. UBI is nothing but the latest carrot to keep the populace happy and distracted while the country gets further into overseas debt. We should not be calling it UBI we should be calling it "BOGUS" - it is just another name for a handout.

How well does this distraction work – actually it works quite well! - It has us wasting our time trying to match the other parties UBI policies. If the “In Government” parties are waiving this around then you need to recognise it as the red flag it actually is. You need to learn to look for the real problem they are trying to distract us from.

Bruce King Mon 11 Sep 2017 6:41AM

Here are the numbers for what NZers would gain or lose in tax under the UBI scenario. 73% are better off & only the top 2% are worse off by more than 10% - so fairly moderate taxation changes required to eliminate poverty in NZ with a UBI..

Bruce King Thu 14 Sep 2017 6:18AM

Under the UBI scenario, both basic income payments to New Zealanders and the collection of individuals income tax are straightforward..

Bruce King Thu 14 Sep 2017 7:17AM

Here's how the UBI scenario would work in the 2016 New Zealand economy. As explained above in slide 10, it assumes only NET payments for basic income and income tax. It is seen that a) the scenario pays for itself, and b) there is no change, to within the uncertainties, in the individuals income tax take.

Bruce King Mon 18 Sep 2017 10:21AM

Wrapped that up with a summary slide:

David Johnston · Thu 31 Jul 2014 6:46AM

@colindavies What would need to change?